GSA’s commercial platforms gaining steam, but data, other concerns persist

Three years into the Commercial Platforms Initiative, the vision Congress had for the initiative isn’t necessarily coming to fruition. But new data and analysis shows that doesn’t mean it’s a failure by any means.

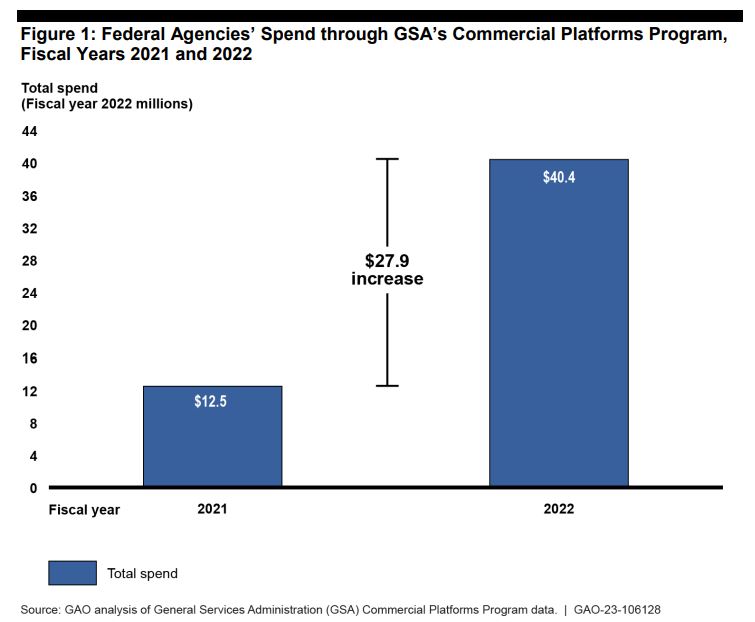

The number of agencies using the platform more than quadrupled between 2020 and 2022 to 27 and the spending, while far below initial estimates of $ 6 billion have increased to $ 40 million last fiscal year.

And beyond the raw numbers, agencies told the Government Accountability Office in a new report that it is saving them time, money and giving them better data about their purchase card spending — all of which were major reasons why Congress created the program in the fiscal 2018 Defense Authorization Act.

“What we are seeing is a rapid increase in the platforms’ use and it’s an interesting experiment,” said Chris Yukins, a professor at the George Washington Law School and a federal acquisition expert. “In the 1990s, the use of the schedule contracts exploded largely because General Services Administration senior executives were pushing hard for line purchasing officials to understand and appreciate the schedules program. It was a successful marketing effort. It was completely appropriate and fine, but it took time for government purchasers to get comfortable. I think the same thing is happening with commercial platforms and we are seeing them get more comfortable with them.”

Where the vision of the CPI is falling well short is lawmakers wanted GSA to develop the platform to make it easier for Defense Department purchasers to find commercial items.

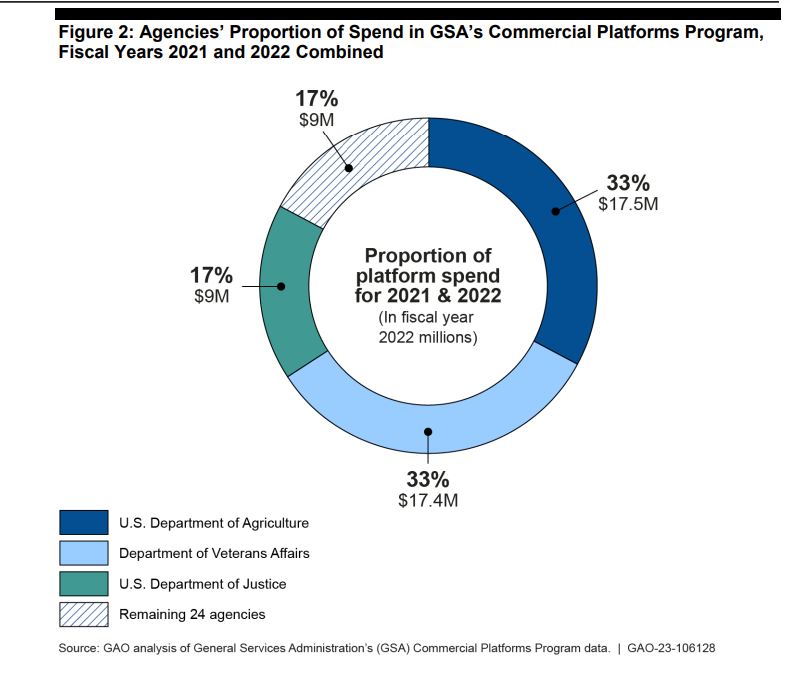

The top agencies using the commercial platforms are the departments of Veterans Affairs and Agriculture.

Yukins said the fact DoD users haven’t found or are not attracted to the platform is surprising.

“We interact with DoD personnel including contracting officers and about one-third to one-half are mid-career contracting officers from DoD. We talk about the commercial platforms initiative in our classes, and what has emerged is DoD is insisting users must be trained and followed rules like Section 508 and Accessibility. That is creating a steep learning curve for those who want to buy from commercial platforms at DoD,” he said. “For those individuals who are required to undertake training, it can be 5 or 6 tutorials before they are allowed to use it. That is a steep mountain to climb for many.”

Another piece of the NDAA vision that isn’t coming together is the goal to create several platforms that agencies could take advantage of. Initially, vendors and others were calling Section 846 the “Amazon amendment” as experts believed the CPI would benefit the online retail giant the most.

That has become the reality as Amazon has accounted for an increasingly larger amount of sales each year with 92% in 2020, 94% in 2021 and 96% in 2022.

The other two platform providers, Fisher Scientific and Overstock Government have struggled to gain a bigger foothold.

Part of the reason seems to be what agencies are buying.

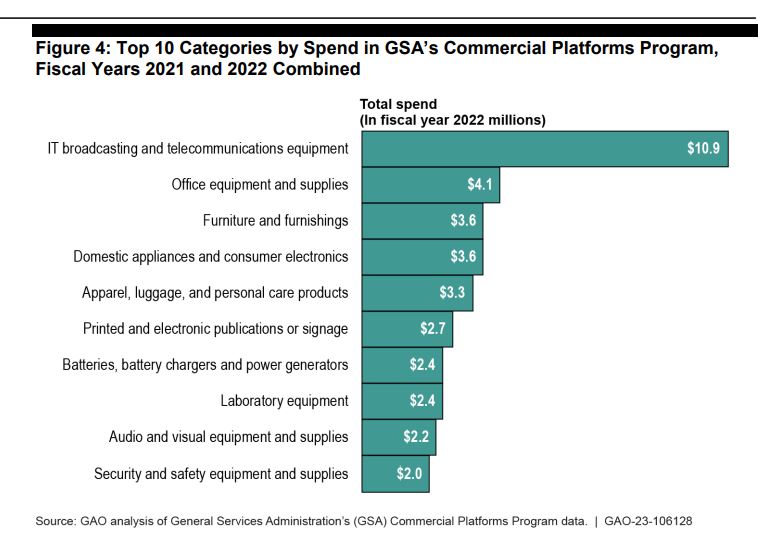

“The average order size was approximately $ 270 per order for fiscal years 2021 and 2022 combined. Agencies spent more on the IT broadcasting and telecommunications category —including computer displays, phone headsets, and computer docking stations — than any other product category in the program,” GAO reported. “Agencies’ purchases in this category were almost three times larger than the next highest category. Agencies also purchased office supplies, furniture and domestic appliances through the program.”

Yukins said it’s not surprising to see that Amazon is the most popular of the platforms given there is little to no learning curve to use it. He said the only real barriers are training and the acceptance of this approach to buying in the first place.

Another long running concern about the commercial platforms was GSA’s ability to collect, understand and share data with agencies.

GAO found mixed results.

On data visibility, GAO says, “Officials from seven agencies said that the program provides increased data and enhanced visibility into purchases made by agency cardholders. For example, officials from two selected agencies stated that the program has provided visibility that they did not have before into what individual cardholders were purchasing.”

But data on sales to small businesses and the use of the AbilityOne program was inconsistent.

The challenges around AbilityOne continue to be a matter of contention. The National Industries for the Blind filed a lawsuit against GSA in February after the agency’s solicitation to expand CPI missed the mark for addressing mandatory requirements for certain products.

Concerns about meeting AbilityOne remain

Kevin Lynch, the CEO of NIB, told Federal News Network in an email that his organization dropped the lawsuit in May after GSA reconsidered its approach to AbilityOne program compliance.

“Ultimately, GSA acknowledged it could do more to ensure that CPI purchases meet AbilityOne requirements and amended the solicitation to strengthen language on compliance. Nonetheless, the report GAO issued concludes GSA could still improve its efforts to help federal agencies increase their use of AbilityOne on the commercial platforms,” he said. “We can’t help but feel vindicated by GAO’s conclusion. Acknowledging that GSA’s actions are ‘steps in the right direction,’ GAO said that, as the implementing agency for the CPI, GSA has the opportunity to provide guidance to federal agencies to increase awareness of, and improve future spend on AbilityOne products.”

GSA re-released its solicitation in May to expand the number of platforms after Congress mandated it in the 2022 NDAA.

As part of the new RFP, GSA is trying to address NIB’s concerns by requiring companies who are submitting offers to have a demonstrated “block and sub” system to ensure that mandatory source AbilityOne items are bought when they should be.

An industry source said GSA likely will ask the vendors bidding to demonstrate the block and sub systems during the live test demonstration of the evaluation process.

“Each company will be scored on how well their system meets the requirements. This will be one evaluation factor for a new award,” the source, who requested anonymity, said. “I do not believe that GSA has yet scheduled the live test demonstrations, but I suspect that this is the next step in the acquisition process.”

GSA says it extended the current three CPI contracts an extra six months through December 2023. They were set to expire in June.

GAO makes two recommendations

GAO stated in its first solicitation for the platform provider contracts, GSA sought platforms that could either mark AbilityOne products as preferred or hide “essentially the same” products, a subset of products that the AbilityOne Commission has identified as essentially the same as AbilityOne products.

GAO says Fisher Scientific and Overstock hide essentially the same products while Amazon marks AbilityOne products as preferred.

“Even with these features, officials from two selected agencies stated that the program’s ability to help them meet AbilityOne mandatory sourcing requirements is a work in progress. For example, an official from one selected agency noted that the search filters on the Amazon platform were not working as expected. The officials from this agency told us that the hierarchy of search filters failed to prioritize products that are mandatory sources (e.g., AbilityOne) above other priorities or preferences, such as products sold by small businesses. Rather, the search filters are all prioritized at the same level,” GAO stated. “During the time of our interviews, Amazon representatives and GSA officials told us they were aware of this concern and are working to resolve the issue. In addition, Amazon representatives told us that they established an AbilityOne online storefront in an effort to increase the availability and visibility of AbilityOne products and increase the number of AbilityOne products sold.”

GSA officials told GAO they have taken steps to educate agency buyers and promote AbilityOne items, such as creating a desk guide that reminds buyers of how to identify AbilityOne items on the platforms and demonstrating how to use search filters in monthly trainings.

“[W]e found that there are opportunities for GSA to help participating agencies improve the process to buy AbilityOne products. Similarly, the program has the potential to help agencies purchase from small businesses; however, it currently does not facilitate participating agencies’ ability to report purchases from small businesses,” GAO stated.

One of GAO’s two recommendations focused on GSA developing a plan to formalize its manufacturer part number efforts intended to help ensure AbilityOne products are procured in lieu of their essentially the same counterparts.

NIB’s Lynch said he hopes GSA takes more aggressive steps to enforce AbilityOne compliance.

“That plan could provide details on how GSA will compare manufacturer part numbers to the list of essentially the same (ETS) products and outline actions that will be taken when GSA identifies that an ETS product has been purchased — including how GSA plans to share this information with agencies,” he said. “We continue to believe that the best way to ensure compliance is to prevent the sale of commercial items that are essentially the same as AbilityOne items to federal customers.”

GAO’s second recommendation focused on small business data. GAO says GSA and the Small Business Administration should develop a better process for agency customers to get credit for small business purchases.

“GSA officials acknowledged that given the potentially large number of agency purchases from individual small businesses with relatively small dollar value, the process is resource intensive, which likely discourages agencies from taking the additional steps required to collect small business contracting credit on applicable purchases,” GAO stated. “In addition, as GSA officials explained previously, businesses would have no reason to register with SAM and certify as small businesses if they do not intend to contract with the federal government.”

Yukins added the fact small business sales can’t be tracked more accurately, suggests platform providers are not delivering line item sales data to the government.

“All of the commercial platform providers are slow to change their models to accommodate government requirements for things like socio economic category tracking,” he said. “What we see here is the intersection of private business practices and government socio economic requirements. Over time as private contractors leverage their negotiations, they could resist accommodating all of the government’s requirements and we may be seeing that play out.”